Term Deposit Calculator - How Much Could Your Savings Grow?

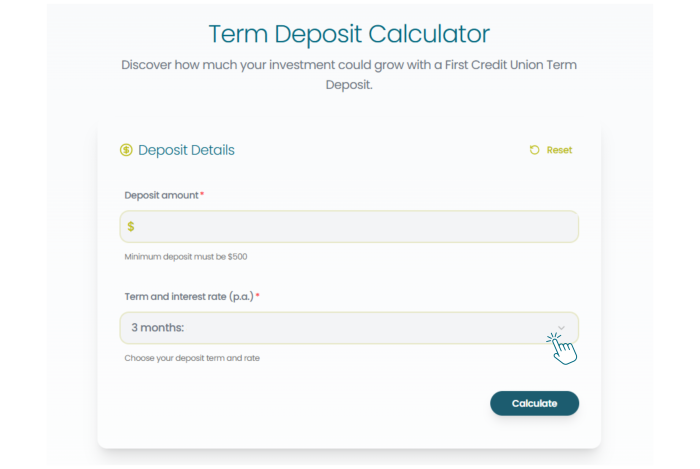

Our Term Deposit calculator is a simple tool that will give you an indication of how much your savings could grow with a First Credit Union Term Deposit. By inputting a few key details, it shows you what you could expect when your investment matures.

Here’s how it works:

Using the First Credit Union Term Deposit Calculator is a straightforward process.

1. Enter Your Investment/Deposit Amount:

This is the amount you plan to invest/ place into a Term Deposit. Start with what you have available – the minimum deposit is $500. This is your principal amount.

2. Choose Your Term and Rate:

The calculator uses First Credit Union’s current rates to give you an indication of what your savings could earn. Use the dropdown to see how committing your money for 3 months, 6 months, 1 year, or 2 years changes your potential return. Term Deposit Calculator.

3. Get Your Estimated Return:

The calculator will show you how much you can expect to earn on your savings/ term deposit when the term ends. It will break down how much of that is your original deposit amount and how much is gross interest earned*.

How much could your savings grow?

*Please note: The First Credit Union Term Deposit calculator is for informational purposes only and should serve as a guide only. It is a simple interest calculator, providing estimates based on the inputted information and a 365-day year basis with interest paid at the end of the term. Term deposit calculations exclude tax. Interest rates are quoted per annum and may change without notice. First Credit Union Term Deposits are covered by the Depositor Compensation Scheme (DCS). Please research to ensure our Term Deposit account meets your needs.

Ready to see what your savings could become? Open a term deposit today.